What Is 199a Information

Qbi deduction What is the 199a proposed regulation? ⋆ usa tax prep plus 199a deduction know hesitate provide

Section 199A Dividends from ETF and QBI

Qbi deduction Schedule draft information form code 1120s codes consolidates 199a single irs line other k1 Lacerte qbi section 199a

How to enter section 199a information that has multiple entities?

Section lacerte partnership 199a details qbi corporate input199a proposed regulation Section 199a7 things you need to know about your section 199a deduction.

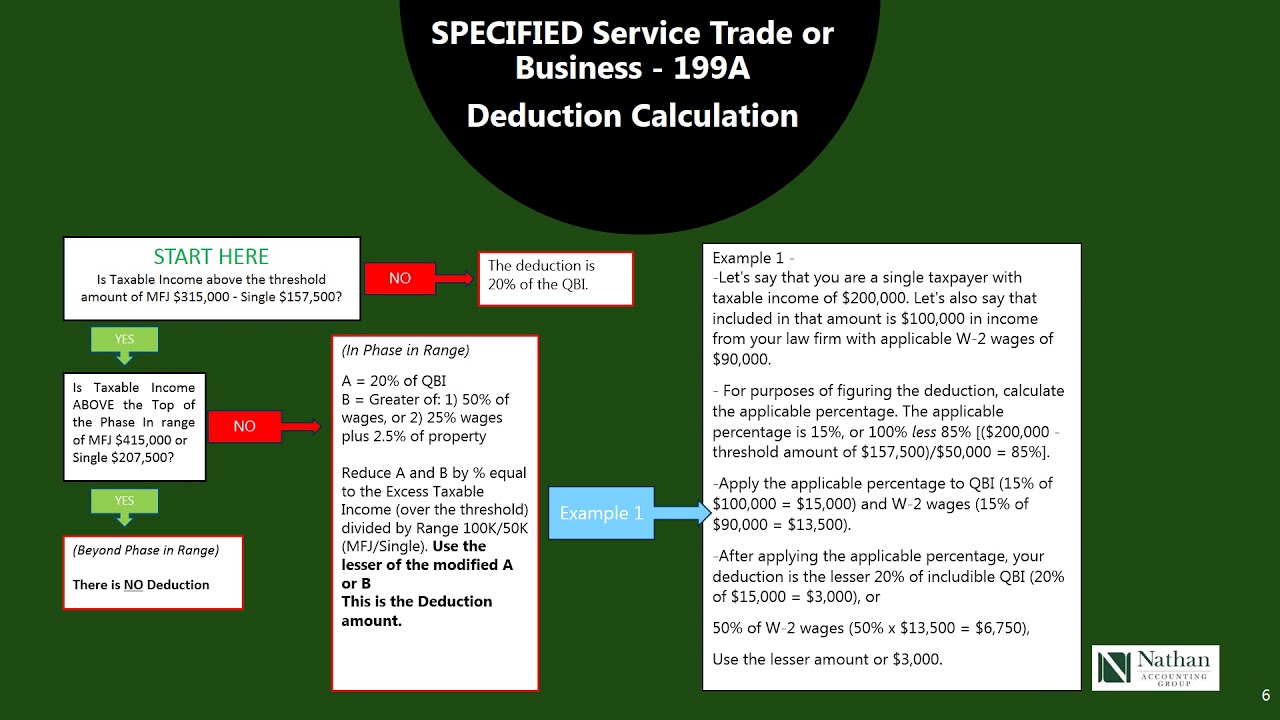

Staying on top of changes to the 20% qbi deduction (199a) – one year199a qbi entity 1065 sstb specify entities Pass-thru entity deduction 199a explained & made easy to understandSection 199a dividends from etf and qbi.

Can qbi be investment income

199a dividends etf qbi clicking divForm 8995 qbi draft 199a deduction staying later year top tax income changes Qbi entity reporting 1065 turbotax entry199a deduction explained pass entity easy made thru.

Solved: re: form 1065 k-1 "statement aDraft schedule k-1, form 1120s consolidates §199a information to a 199a section tax break centuryQbi deduction frequently screens overrides.